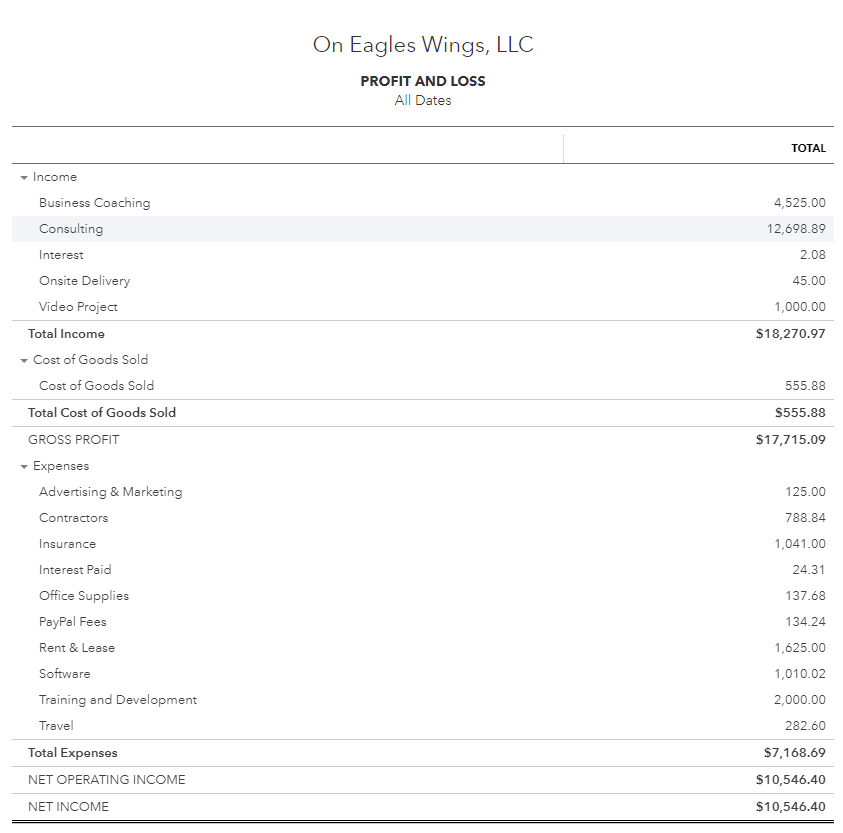

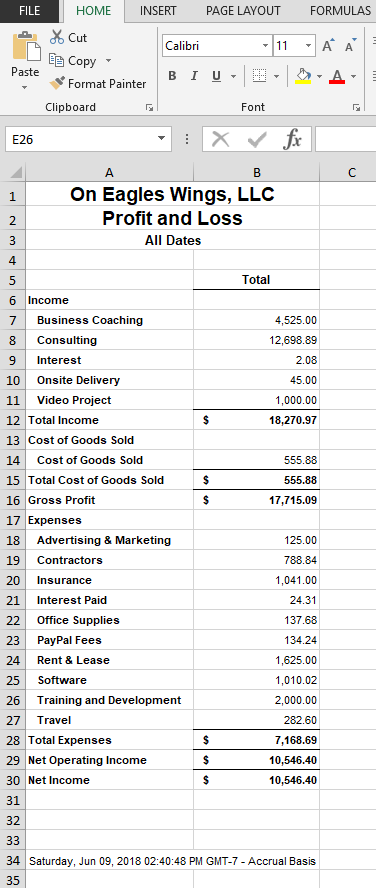

The Profit and Loss report is a financial document that shows income and expenses subtotals for a certain period of time. It is a very important document that is needed to report income for a tax period year. The report is also known as the Income Statement.

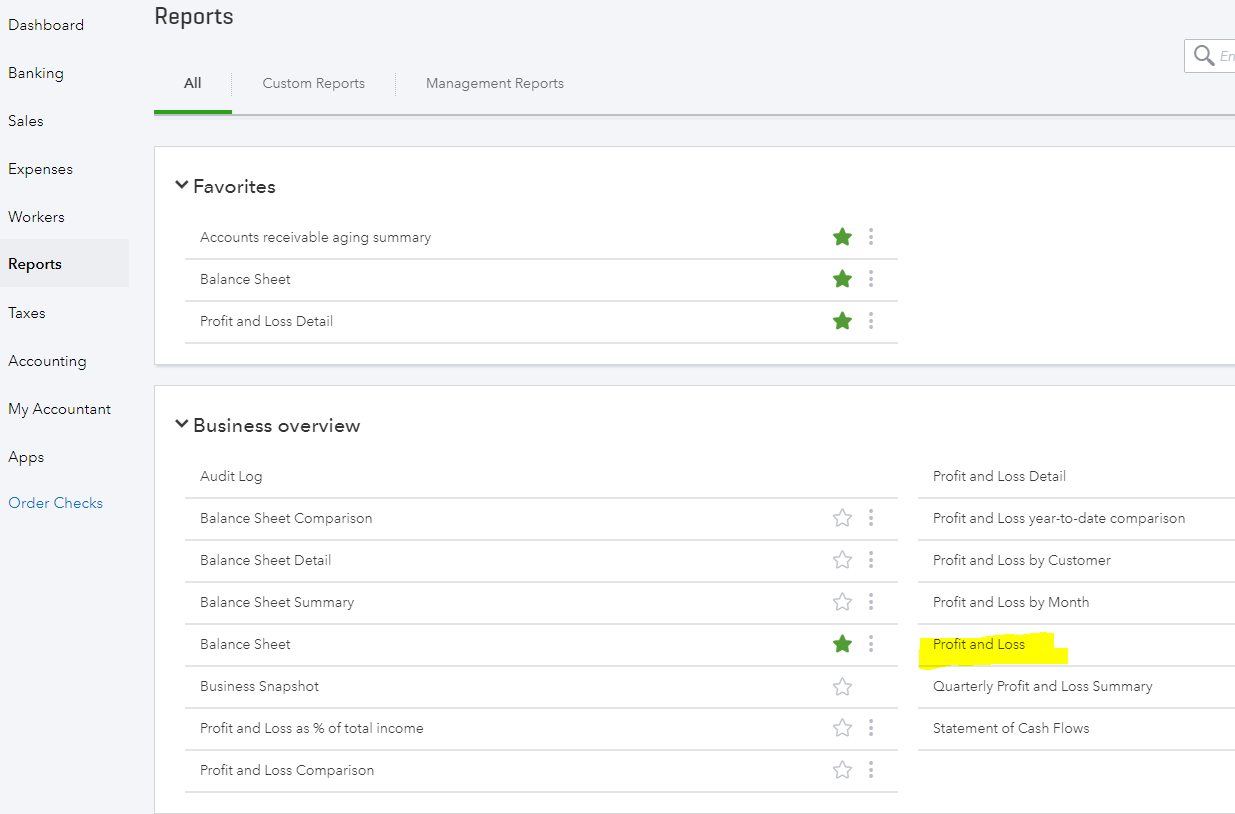

Step 1: Click Reports on the left navigation tab and the select Profit and Loss report from the Business Overview category.

Step 2: Change the date for the period you want to report

- Custom Range

- All Dates

- Today

- This Week

- This Week to-date

- This Month

- This Month to-date

- This Quarter

- This Quarter to-date

- This Year

- This Year to-date

- This Year to-last-month

- Yesterday

- Recent

- Last Week

- Last Week to-date

- Last Month

- Last Month to-date

- Last Quarter

- Last Quarter to-date

- Last Year

- Last Year to-date

- Since 30 Days ago

- Since 60 Days ago

- Since 90 Days ago

- Since 365 Days ago

- Next Week

- Next 4 Weeks

- Next Month

- Next Quarter

- Next Year

Step 3: (Optional) Select the Display columns by

- Total Only

- Days

- Months

- Quarters

- Years

- Customers

- Vendors

- Employees

- Products/Services

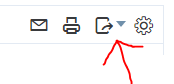

Step 4: Click the export button which is in the upper right corner of the report. It is a tiny button that looks like a piece of paper with a curved arrow.

Step 5: Select “Export to Excel”

Step 6: Type a name for the P&L report and select where to save it

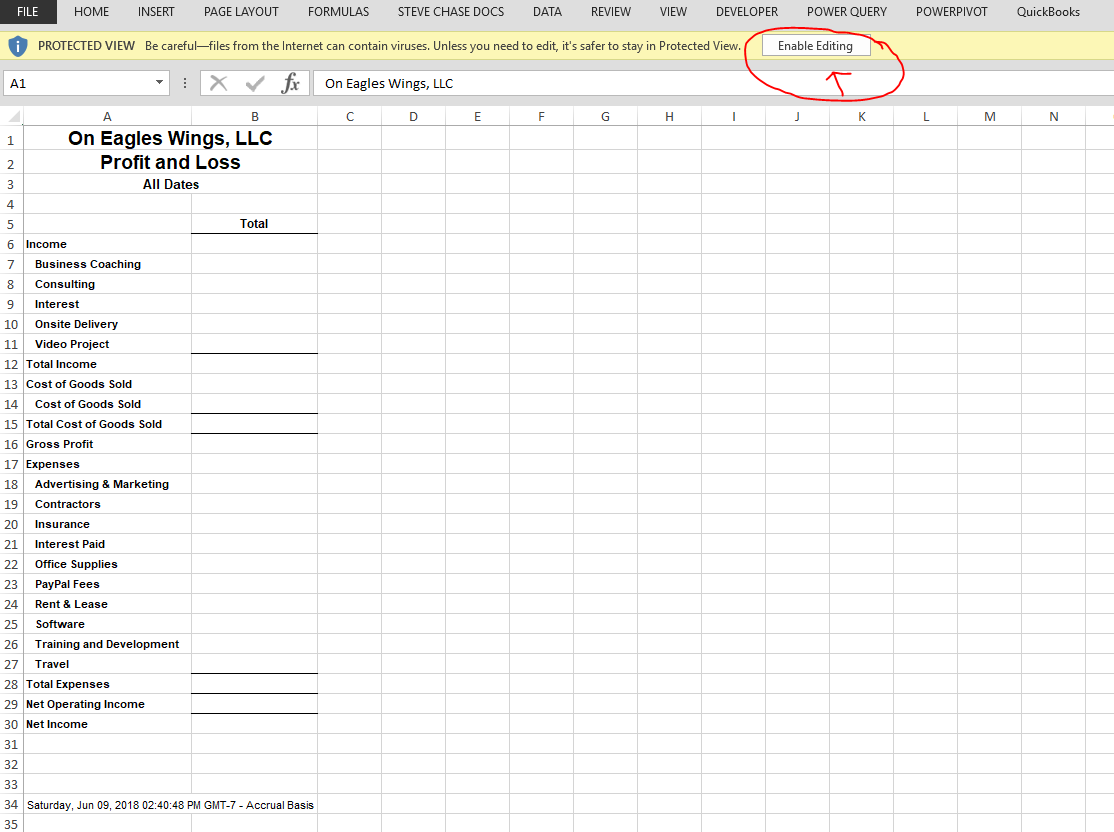

Step 7: Open the Excel file and select “Enable Editing”. When you open Excel it will not display any numbers until after you click the “Enable Editing” button.

Step 8: Review the Profit and Loss (Income Statement) in Excel.

Leave A Comment